- Roles and Specializations

- Defender • Knight • Marshall • Juggernaut

- Striker •Berserker • Brigand • Warden

- Supporter • Sentinel • Duelist • Warlord

- Tradeskills

- Hunter • Forester • Prospector • Armorsmith • Weaponsmith

- Woodworker • Tinkerer • Provisioner • Outfitter

|

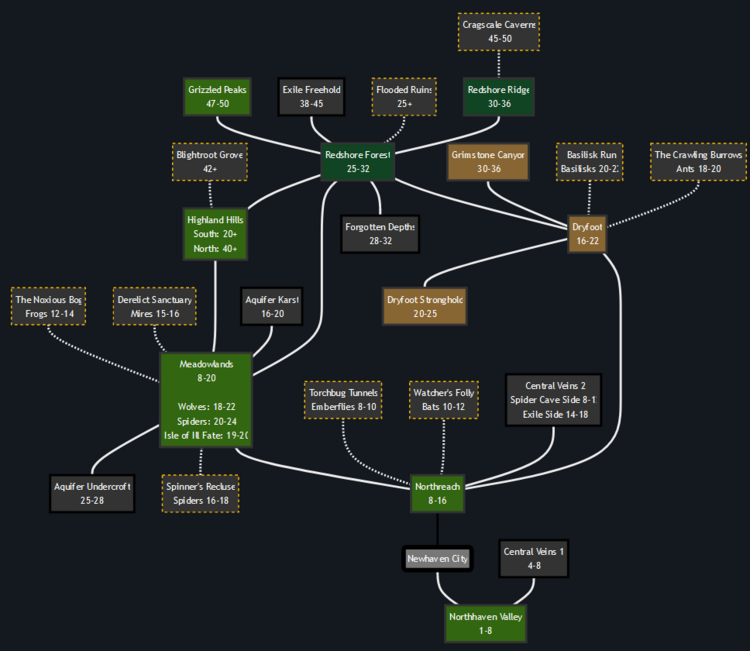

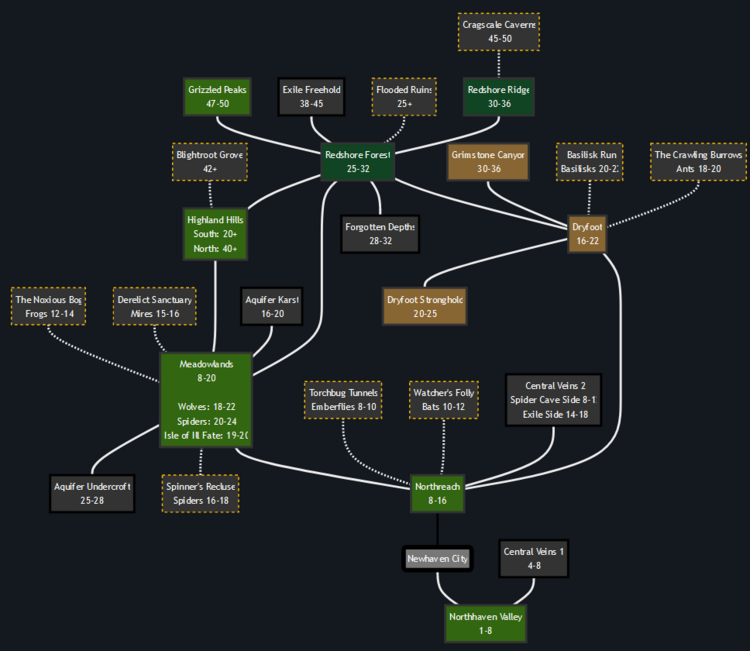

- Zones

- Ember Veins • Dungeons • Solo Loops

- Quests

- Ember Quests • Standard Quests • Tradeskill Quests

- Items

- Armor • Weapons • Tools • Crafting • Consumables • Misc • Reagents

- NPCs

- Bulletin Boards

|

- Game Updates

- Official Site

- Official Forums

- Official Discord

- Wiki Discord

- Wiki Getting Started

|